Momentum

Ahhh...high school physics class...lots of wonderful memories! It was here that we were introduced to the concept of “momentum”, a measure of the rate of change of an object in motion.

Years later, the concept of “momentum” popped back into view unexpectedly in the field of finance. For investors, momentum refers to the rate of change (price performance) of an investment relative to competing assets. Studies on investment performance among stocks showed that momentum exists in relative stock price movements. Stocks that outperformed (high momentum) in the recent past tend to continue to outperform in the future. In other words, winners keep winning and losers keep losing.

For me, a value investor with a firm belief in turnarounds and “reversion to the mean”, the concept of momentum seemed implausible. After all, we know that nothing outperforms indefinitely. However, upon closer consideration, I came to understand how the momentum factor coexists and compliments the value factor. But I’m getting ahead of myself; first let’s review the momentum factor on its own merits.

For a long time, the concept of “relative strength” of stock price performance was used on Wall Street. Relative strength ranks stocks by their performance relative to the market index, so it is one measurement of momentum. In 1967, Robert Levy published a study that documented superior performance to stocks ranking higher on relative strength.1 It took until 1993 for the next thorough analysis to appear of how past performance impacts future performance among stocks in a published study by Jegadeesh and Titman.2 They ranked stocks by performance over the past 3, 6, 9 and 12 months. Then they grouped stocks into equally weighted deciles by performance rank and measured each decile’s return over the forward 3, 6, 9- and 12-month periods. They defined the momentum “premium” as difference between the subsequent performance of the portfolio composed of the top 10% (winners) minus performance of the portfolio of the bottom 10% (losers). Their studies showed that the winners beat the losers in most categories by statistically significant amounts. The best performing measurement – a whopping 1.5% per month return- came from using the past 12 months for ranking and measured over the next 3 months.3 They also observed that the positive performance dissipated as the holding period lengthened from 3 months to 12 months.

They continued to watch the relative performances of these portfolios out to 3 full years. The long-term results showed that in each month of year 2, the performance advantage of the winners was reversed and then in year 3 the performance differential was near zero. Thus, if you held the long-short momentum portfolios for a full 3 years, the benefits of momentum were “not statistically different from zero”.4 From their work, we learned that momentum was a factor in equity returns and that its positive impact is mostly short term.

Along with several other researchers, Jegadeesh and Titman observed that momentum factor performance improves if the past performance period includes a “lag”. For example, the most common performance ranking method would create portfolios for September 30, 2019 by measuring their performance from October 1, 2018 through August 31, 2019. This method eliminates the most recent month because it tends to show a “reversal” effect, which is temporary and related to trading patterns.

Thus, a conventional definition of momentum and the momentum factor is described by Berkin and Swedroe: “Here we define momentum as the last 12 months of returns minus the most recent month...The momentum factor is the average return of the top 30 percent of stocks minus the average return of the bottom 30 percent as ranked by this measure.”5 From 1927 through 2015, this long-short measure for the momentum factor produced returns of 9.6% annually in US stocks- quite remarkable! Now let’s see how the momentum factor holds up in the five tests that guide us on the potential for use in our investment approach.

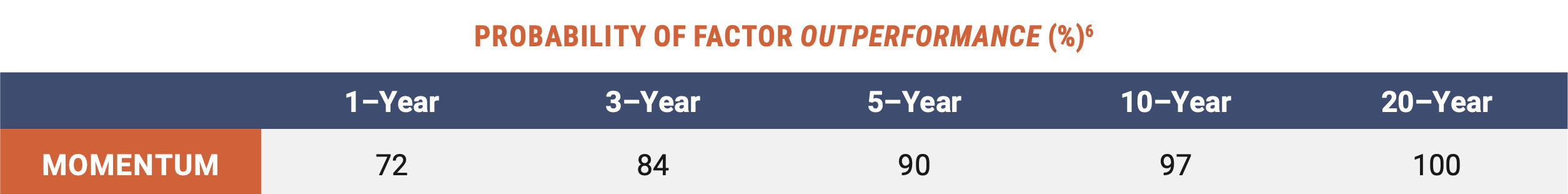

Persistence refers to how probable the performance advantage is across long time periods and different economic conditions. In this gauge of reliability, momentum is the leader among the five equity factors. As seen in the table below from Swedroe, the momentum factor has been exceptionally persistent over 5, 10 and 20-year rolling periods.

The authors state, “Over the period from 1927 through 2015, not only has the momentum premium been larger than the United States equity premium (9.6% versus 8.3%), it has been more persistent.”

The advantage to portfolios of momentum stocks is significant and highly probable over time. Even with this strong history, we must note that momentum’s positive returns are not guaranteed in any time frame, especially in the short term. We will discuss this more in later sections.

PERVASIVE means that the factor holds across different countries, regions and asset classes. Numerous studies have been published documenting the existence of the momentum premium across the globe and within a variety of asset classes beyond equities, including bonds, currencies, and commodities. The “Godfathers” of factor research, Eugene Fama and Kenneth French, published a comprehensive study in 2012, “Size, Value, and Momentum in International Stock Returns” that documented statistically significant returns to momentum in all markets except for Japan.7 They found particularly strong returns to momentum among the small capitalization groups.

Perhaps the most comprehensive, Geczy & Samonov’s 2015 research paper analyzed the returns to momentum going back all the way to 1800.8 Their study found that momentum premiums were consistent and significant in each asset class and across various countries.

Other widely quoted research by Moskowitz (2010)9 and Asness, Moskowitz & Pedersen (2013)10 applied the momentum factor in numerous foreign equity markets and in more than a dozen asset classes besides equities. Their analysis showed similar significant effectiveness for momentum across these broad applications.

ROBUST focuses on the ability of the factor to work in a variety of specific measures. In their 1993 study, Jegadeesh & Titman created a variety of momentum measures using differing time frames for creating the momentum ranking. Momentum was evident using various measures, giving us confidence that the observed momentum premium is robust.

INVESTABLE refers to the practical application: does the Factor’s performance advantage survive when real world costs of trading and implementation are incurred? This test is challenging to the momentum factor due to the inherent short-term nature of the momentum effect.

Research has shown that the momentum premium is strongest in short periods such as 3 months. The premium erodes as the time frame lengthens out to 12 months. Then, in subsequent years, the premium reverses. Why? Basically, it comes back to reversion to the mean. Within the portfolio of high momentum stocks, some portion of those stocks hit their peak as exuberant investors chase the stock, then decline either out of exhaustion, revaluation or a change in news. When these stocks reverse, the performance versus the market can be quite negative. The longer that we hold the original portfolio of top momentum stocks, the higher percentage of the portfolio enters reversion to the mean. Mean reversion is also acting on the poor momentum portfolio, with increasing numbers of the losers rebounding to good performance as time passes. Thus, by the time we get out to beyond a year, the performance advantage of the momentum stocks reverses.

Therefore, to preserve the momentum premium, the holdings of the momentum portfolio must be frequently “refreshed”, selling the stocks that lose momentum and adding the new arrivals from the more recent rankings. This process results in a lot of trading and very high portfolio turnover; for example, the iShares Momentum Factor ETF (MTUM) has recorded over 100% turnover annually. The frictional costs of trading, both commissions and spreads, can be quite significant. Thus, many practitioners are reluctant to use the momentum factor in their approach. However, iShares established MTUM in 2013 and the fund has delivered good results even with the turnover friction. Awarding MTUM 5 stars, Alex Bryan at Morningstar noted on March 27, 2019 “From its inception...it outpaced the Russell 1000 Growth Index by 140 basis points annually, with comparable volatility.” It has beaten the broad market indices by considerably more. We observe that despite the challenges, MTUM and comparable ETFs offer an effective way to invest in the momentum factor.

The INTUITIVE test is common sense oriented. Are there logical, risk-based reasons or documented behavior-based reason for the factor to exist? For momentum, several behavioral theories supporting the factor have been presented. “Anchoring and Adjustment” was described by Kahneman and Tversky in 1975; this theory suggests that when a surprising trend of data pops up, it takes a while for the impact, good or bad, to be fully reflected in the stock price. “Herding”, or the tendency of investors to chase after stocks popular with the crowd, may also underpin the momentum effect. “Overconfidence” is another behavioral bias that supports the momentum effects, which can be summarized as the investor’s unwarranted faith in their intuitive reasoning, judgements and cognitive abilities. There appears to be enough weight behind the behavioral explanations to suggest a sustainable, intuitive factor.

Momentum is the most challenging of factors for portfolio construction. It has several positive attributes:

Offsetting these pluses, momentum also has one particularly problematic attribute: when its good, its very good and when its bad, its awful. Portfolios built on momentum do poorly in periods of high volatility and market reversals. For example, in 2008 the momentum portfolio would have declined by 40.9 % as compared to 37.1 % loss for the S & P 500. When the market bounced in 2009, the momentum portfolio continued to trail by almost 10%. It took the momentum portfolio 3 more years to catch up to the broad market index.

The occasional appearance of momentum “crashes” creates a real behavioral dilemma. We know that most major mistakes are made by investors fleeing risk assets during and after market declines. Considering that bad performance will likely be made worse by the momentum portfolio, the added psychological pressure at that moment may be the straw that breaks the camel’s back for many investors. At HPA, we carefully construct risk profiles for our equity clients, which then guides us in our approach to implementing momentum exposure. For clients more sensitive to downside capture, we must limit the exposure to momentum. An excellent offset to the momentum effect during market volatility is exposure to the quality and low volatility factors.

In summary, we view momentum as a valuable factor. As with all the factors, its unique characteristics require “blending” withother ingredients to get the proper recipe for a specific portfolio. For investors with appropriate risk tolerance, momentum can add plenty of flavor!

1Levy, R. A. (1967). Relative Strength as a Criterion for Investment Selection. The Journal of Finance, 22(4), 595–610. doi: 10.2307/2326004

2Jegadeesh, N., & Titman, S. (1993). Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency. The Journal of Finance, 48(1), 65–91. doi: 10.2307/2328882

3Jegadeesh, N., & Titman, S. (1993) p.69. Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency. The Journal of Finance, 48(1), 65–91. doi: 10.2307/2328882

4Jegadeesh, N., & Titman, S. (1993) p.83. Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency. The Journal of Finance, 48(1), 65–91. doi: 10.2307/2328882

5Berkin, A. L., Swedroe, L. E., & Asness, C. S. (2016) p.87. Your complete guide to factor-based investing: The way smart money invests today. St. Louis, MO: BAM ALLIANCE Press.

6Swedroe, L. (2018, November 5). What to do When an Investment Strategy Performs Poorly. Retrieved from https://www.advisorperspective...;to-do-when-an-investment-strategy-performs-poorly

7Fama, E. F., & French, K. R. (2012). Size, value, and momentum in international stock returns. Journal of Financial Economics, 105(3), 457–472. doi: 10.1016/j. jfineco.2012.05.011

8Geczy, C., & Samonov, M. (2015). 215 Years of Global Multi-Asset Momentum: 1800-2014 (Equities, Sectors, Currencies, Bonds, Commodities and Stocks). SSRN Electronic Journal. doi: 10.2139/ssrn.2607730

9Moskowitz, T. J. (2010, June 1). Explanations for the Momentum Premium . Retrieved from https://www.aqr.com/Insights/Research/White-Papers/Explanations-for-the- Momentum-Premium

10Asness, Clifford, T. Moskowitz, and L.H. Pederson. “Value and Momentum Everywhere.” The Journal of Finance, Vol. 68, No. 3 (2013), pp.929-985.

INVEST SMARTER

Call (585) 485-0135 to discuss how a factor-based approach could pay off for you.