Since our inception, High Probability Advisors has committed to rigorous research and an evidence-based investment approach. We recently revisited our analysis on the “optimal” regional allocation. The result was a refined perspective on the allocation.

THE CASE FOR INTERNATIONAL EXPOSURE

First, let’s ask: “Why should U.S.-based investors consider international stocks? After all, the U.S. stock market is unparalleled in its depth, resilience, and innovation. Its diversified economy and the U.S. dollar’s role as the global reserve currency provide a natural advantage. Since the early 1990s, U.S. markets have delivered superior returns with lower volatility compared to many international markets and has often acted as a safe harbor during periods of market distress.

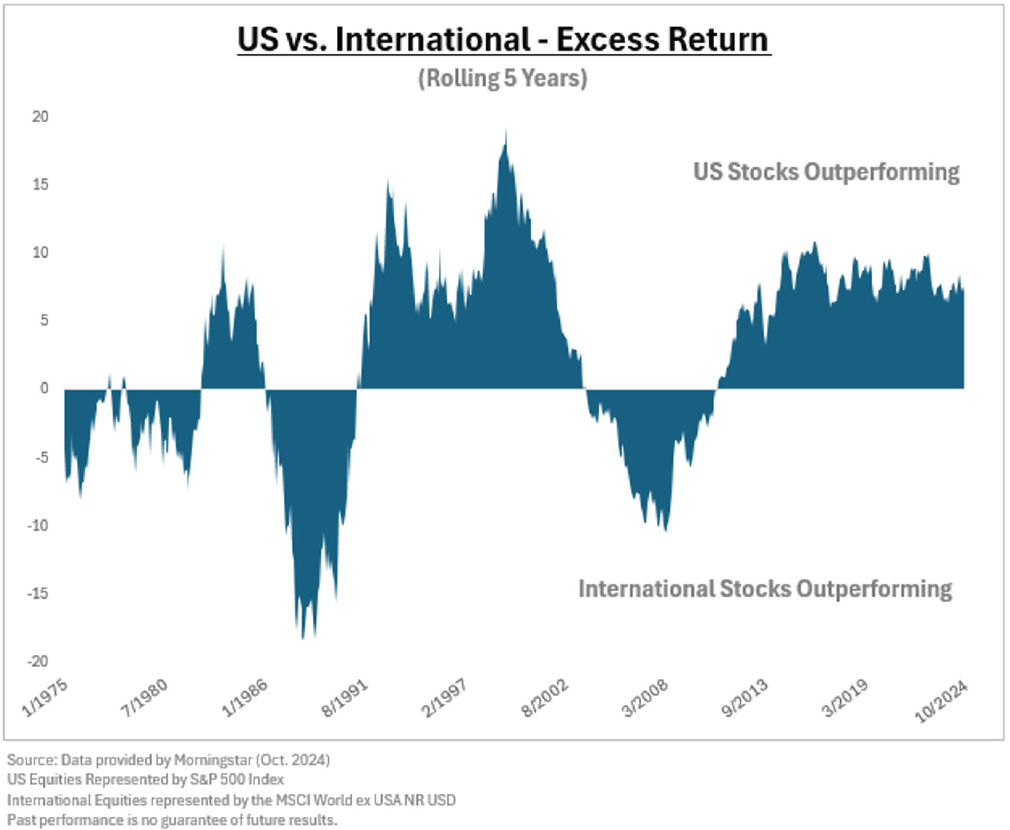

On the other hand, international stocks provide diversification with periods of strong returns in the past relative to the U.S. international companies (excluding global brands) often operate in distinct economic environments, serving different customer bases and responding to unique regional dynamics. These differences reduce correlations between U.S. and international markets. By incorporating both into a portfolio, investors can enhance long-term risk-adjusted returns while mitigating overall volatility.

THE CASE FOR MANAGING RISKS OF INTERNATIONAL EXPOSURE

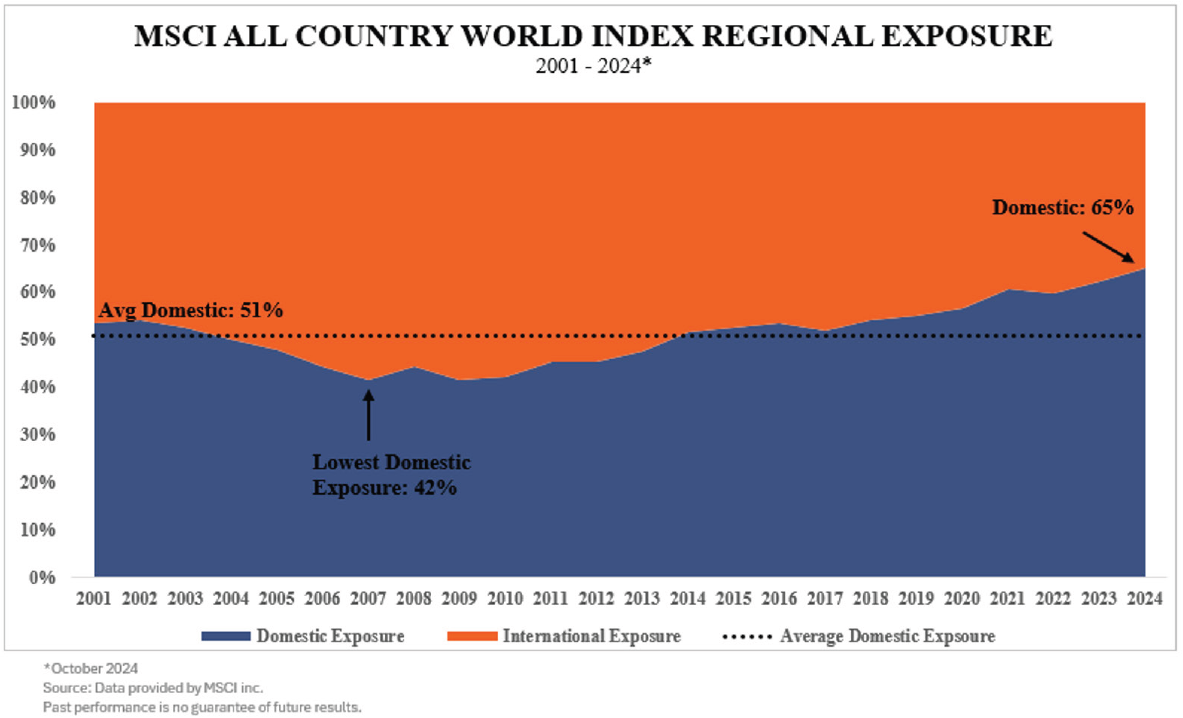

The All Country World Index (ACWI) represents total global equity markets by weighting countries according to their public companies’ aggregate market capitalization. Today the index represents 65% US exposure and 35% International exposure. This is a record high weight to US stocks; less than 20 years ago, US stocks were only 42% of the Index following a period of superior performance by International stocks.

The accompanying graph to the right shows the dramatic shift in the regional weightings over time. Attempting to mimic the ACWI’s allocation potentially adds a risk to the table of untimely reallocation, with the hype around one region inadvertently leading to increasing exposure to regions just before market downturns, as we saw with Japan in the late 1980s and with BRIC (Brazil, Russia, India & China) stocks in the late 2000s and early 2010s.

Also, a lower weight to international stocks makes sense for US investors because our liabilities are denominated in USD. Currency risk plays a major role. Exchange rate fluctuations can significantly affect the returns of foreign investments when converted back to U.S. dollars. For instance, a stronger U.S. dollar can diminish returns on investments denominated in weaker foreign currencies, even if those investments perform well in their local markets.

Finally, investing in international markets, particularly in emerging economies, may introduce significant country-specific risks. Some of these economies face lower economic stability and heightened vulnerability to external shocks, such as commodity price fluctuations, trade disputes, and geopolitical tensions.

For these reasons, the full weight of international stocks represented in the ACWI is more than most U.S.-based investors need to pursue their investment objectives. Others have recognized this as well – the typical U.S.-based investor allocates 70% to U.S. stocks and 30% to international stocks. While this commonly adopted ratio offers reasonable diversification, we believe it reflects more of a herd mentality than rigorous research.

HPA’S STRATEGY: A DELIBERATE, DATA-DRIVEN APPROACH

While we fully acknowledge the benefit of global diversification, our research has identified a “tipping point” where adding more international exposure ceases to provide meaningful compensation and instead just increases the risks noted in the previous section.

HPA’s research efforts specifically focused on performance neutral and currency neutral periods of time, i.e., isolating the diversification benefits, free from the influence of one region outperforming the other over a certain period. We found that beyond a certain threshold, international exposure begins to erode the risk-adjusted return. Thus, the tipping point identifies our recommended target allocation and optimal balance of 78% US and 22% international exposure. However, at the same time, our portfolio managers place great emphasis on reducing the number of trades and potential tax liabilities generated by trading activity that will negatively impact performance overtime. For this reason, while 78/22 is the target, portfolio allocations will be maintained within a defined range of that target.

We believe our approach to regional allocation and efficient trading process will maximize your long-term risk-adjusted returns while minimizing unnecessary volatility, a significant improvement over cookie-cutter allocations that may fail to serve your best interests.

INTERESTED IN LEARNING MORE?

If you would like to explore the research supporting our allocation strategy or discuss how it aligns with your portfolio objectives, please let us know and we would be happy to schedule a meeting with a member of our Research Team.

INVEST SMARTER

Call (585) 485-0135 to discuss how a factor-based approach could pay off for you.