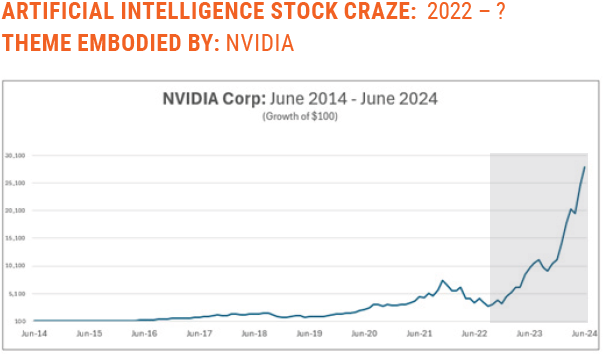

A HOT STOCK

The Wall Street sales machine and business media love to trumpet the enormous investment potential of the “next new thing!” Lately, we hear that the sky is the limit, and the profits are unimaginable for the bold investor in Artificial Intelligence. Just look at NVIDIA…wouldn’t you love to have had a big position of that one in your account?

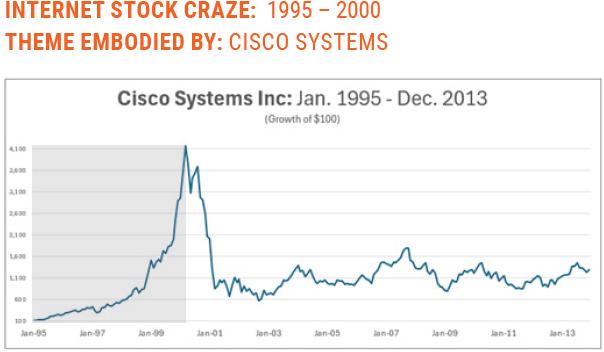

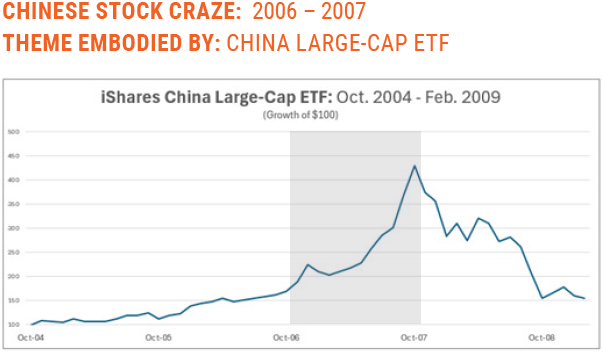

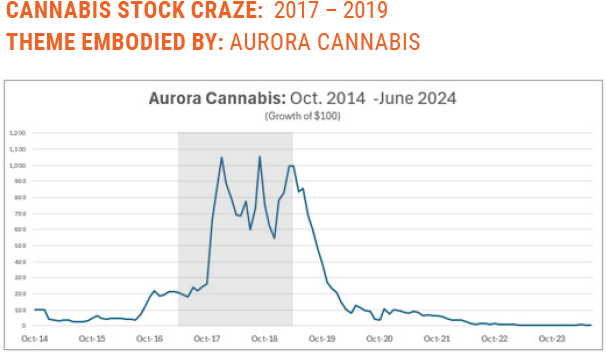

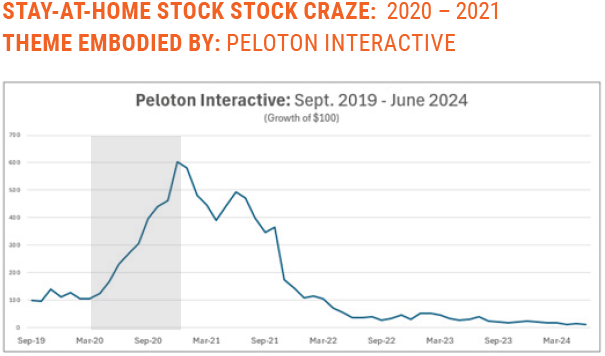

We all would. Yet, while FOMO (the Fear of Missing Out) can have a powerful impact on investors, we also can remember so many hot stocks that fizzled even when there was substance to the story. Today, it’s artificial intelligence. In 2020, it was stay-at-home stocks like Peloton. In 2018, it was cannabis stocks like Aurora Cannabis. In 2007, it was Chinese stocks like FXI, the iShares for the China large cap index. In 1999, it was internet stocks like Cisco. We could keep going, but you get the idea.

Even if we believe we are coming to the party early, investing in hot stocks has several challenges. Let’s take a look at the decisions that face the intrepid investor.

JUMPING IN AND STAYING IN

In the early stages of the trend, the hot stocks are rockets…rising steadily and leaving the mundane stock market behind. What we read about the next new thing must be true; everybody wants in! So, full of confirmation bias, we click the “Buy” button and now we own NVIDIA. Hopefully, our stock is now appreciating. If so, then we are so, so glad! It’s our favorite cocktail party story. We are determined to hold for the long term.

TURBULENCE

Of course, we know that every hot stock has a bit of volatile price action now and then. When the stock price drops quickly, we shrug it off or even think about “buying the dips”. However, a drop sustained for more than a few days makes us wonder…should we lighten up? If we are fortunate, the company’s stock bounces back and gives us comfort that the long-term opportunity is intact.

TAX HANDCUFFS

As the stock appreciates, we have another reason to resist hitting the “Sell” button: taxes. The unrealized gain begins to erode our willingness to sell because we’ll have to pay taxes on the sale. The desire to avoid the tax payment keeps us locked in.

THE SELL DECISION

Yet, we know that our stock won’t stay hot forever, so what is the key information that will lead us to sell part or all of this holding? We know that stock prices usually begin to reflect changing circumstances well in advance of those changes becoming apparent. If we read in The Wall Street Journal about a negative surprise, our stock is probably already down. Should we sell it then? Or is this a buying opportunity? It’s so difficult to know because the future is uncertain. Even the so called “experts” in the media will have conflicting opinions. Who do you trust?

DO YOU FEEL LUCKY?

The original bottom and ultimate top are only easy to identify in hindsight. There are many challenges to buying low and selling high. Playing the Hot Stock Game requires you to make the right decision every day – buy, sell or hold. That takes a lot of smart or lucky guesses! How do we bring discipline to raise the odds of success?

MOMENTUM

The smart way to get exposure to “the next new thing” is to employ the Momentum factor. This factor was first identified in academic studies that showed past strong returns will persist for a period of time.

We use MTUM, the Momentum factor ETF offered by iShares. This ETF uses proven quantitative buy and sell techniques that can help us put discipline to hot stocks, guiding us to own more of them while trends are favorable and the party is in full swing, but then backing off those exposures when investors start leaving the party and trends are deteriorating. As an owner of this ETF, the sale of highly appreciated stocks has not triggered a tax bill for you! A far different experience than attempting to buy and sell hot stocks directly in your account.

Does Momentum always capture hot trends seamlessly? No, there are occasional “momentum crashes” when the hot stocks’ demise is a swift reversal of fortune rather than a slower weakening of the good news. The momentum factor has heightened volatility. As a result of this risk profile, MTUM plays a complimentary role in our factor blends.

CONCLUSION

Your portfolio has benefited from exposure to Artificial Intelligence stocks via our holdings in the Momentum and Quality factor ETFs. Our factor disciplines guide us to “participate, but don’t overweight” as the Value, Size and Minimum Volatility factors keep us balanced in the exposure. Like the Internet in the late 1990s, we think AI is real and will be with us for a long time. However, as we’ve seen in every “next new thing”, the stock market hype will subside. We are confident that our factor-based disciplines will allow your portfolio to adapt to the inevitable changes, bringing continued success without having to pursue the low probability exercise of chasing the next hot stock.

THE "NEXT NEW THING" (Represented by Shaded Area)

Past performance is not indicative of, and cannot ensure, future results.

Data Source: Zephyr and Morningstar (June 2024)

Disclaimer: All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy, or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Diversification neither assures a profit nor guarantees against loss in a declining market. The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness.

INVEST SMARTER

Call (585) 485-0135 to discuss how a factor-based approach could pay off for you.