INTEREST RATES: UP, UP & AWAY!

Since March 2022, the Federal Reserve has voted to increase rates in 11 out the last 14 meetings, moving the federal funds rate from effectively 0% to over 5.25%. Similar tightening measures were deployed by central banks around the world as they collectively battled post pandemic and geopolitical inflationary pressure. The Fed has communicated an expectation of “Higher for Longer” to reach their longer-term goals of employment and price stability.

The impact of higher rates on the global financial system has been widespread, including the repricing of stocks and bonds to reflect the new rate regime. While the impact has been wide, the results have not been uniform.

US BOND YIELDS – VERY ATTRACTIVE!

When rates increase, the price of existing bonds decreases. This makes sense, an investor trying to sell a bond with a yield that is less than what a buyer could attain from a newly issued bond, must do so at a discounted price. This is exactly what occurred when the US bond market repriced in late 2021, 2022 and thus far in 2023, with performance of -1.5%, -13.0% and -1.2%, respectively.

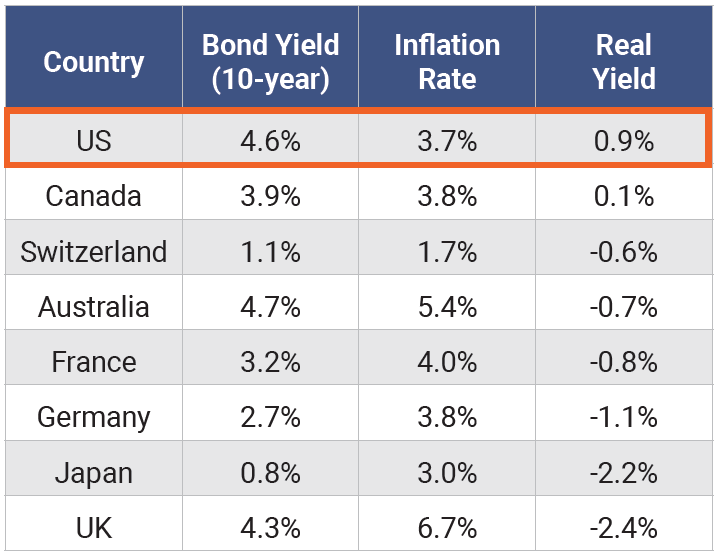

While never an enjoyable experience, the bright side of this upward rate adjustment is that investors can finally generate meaningful income off their bond portfolios. The 10-year US Treasury is yielding 4.6%, which is 3.1% more than an investor would have received at the end of 2021!

As inflation has started to slow, higher bond yields combined with lower inflation have produced positive “real yields”. This is something that has been absent since the Great Financial Crisis. Real yields tell an investor what they will receive in income after accounting for erosion from inflation. Today, the US has the highest real yield of any developed market (see table to right).

Valuations for US Treasuries are at the most attractive levels in many years based on positive real yields and compared to the global landscape. Throughout the ‘yield drought’ years, stocks were bolstered by the acronym ‘TINA’ (there is no alternative). Well, now there’s an alternative!

US STOCKS – SLIGHTLY ABOVE HISTORICAL VALUES? YES.

CHEAP AS US BONDS? NO. CHEAP AS INTERNATIONAL STOCKS? NO.

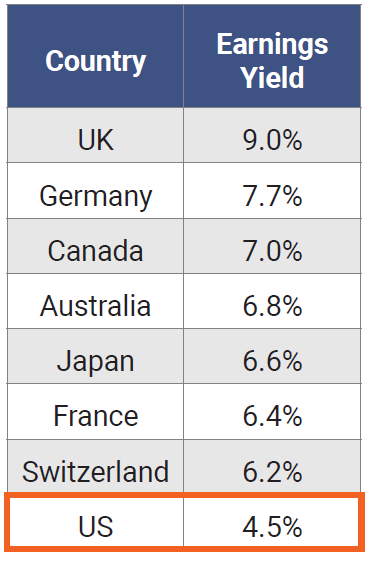

The Earning Yield (earnings/share price) provides a simple method to compare US Stock valuations against US Bonds as well as other international stock markets. The higher the yield, the cheaper the valuation.

US stocks currently have an earnings yield of 4.5% which is essentially flat against US Bond yield of 4.6%. As bond rates increased, it forced earning yields on stocks to increase as well. To do so, market participants pushed stock prices down to increase the earnings yield. This is what occurred when stocks repriced in 2022, selling off by more than 18% by year end. This sell-off pushed valuations below the 25-year average for stocks by year end, for the first time since the pandemic.

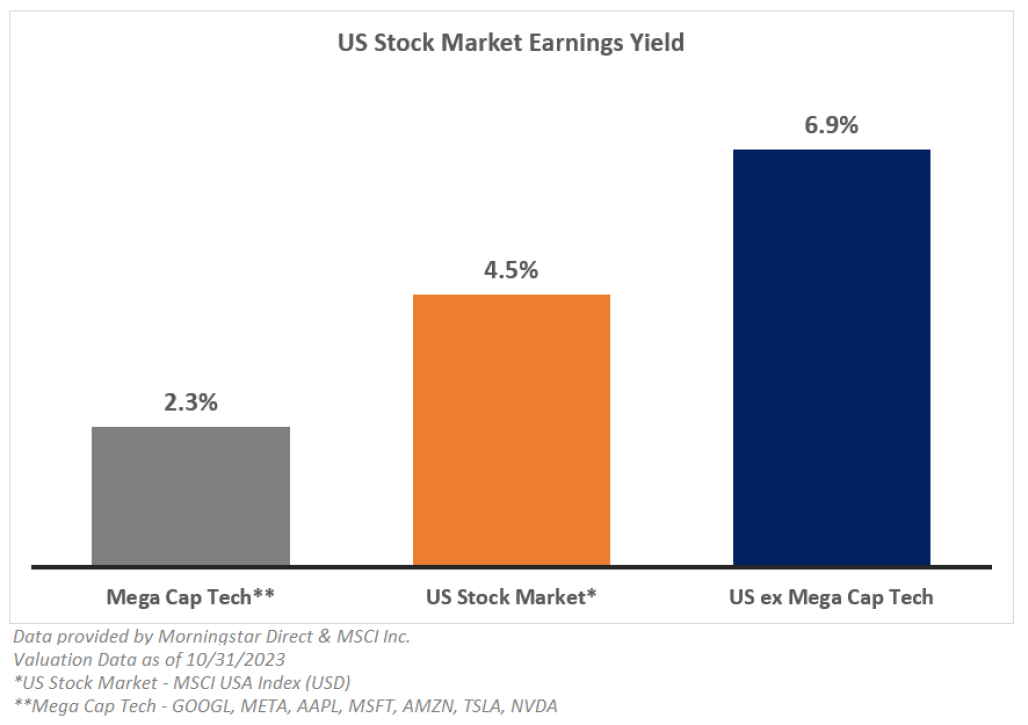

On the other hand, from a global perspective, US stocks have drastically outpaced international stock markets over the last 15 years, outperforming by a whopping 7% per year. As prices increased, earnings yield decreased, and valuations rose. This has resulted in an earnings yield that is less than other developed markets. While US valuations look expensive from a global perspective, the primary contributors to those valuations are a small group of mega cap tech stocks, with significant weights and a large influence over the broad indexes like the S&P 500.

When we exclude this group of stocks, the earnings yield of US stocks grows to 6.9%, putting it within the range of the other countries. This suggests that the valuations for the great majority of US stocks are reasonable.

TAKE-AWAY

The script has been flipped. Today, US Bond valuations are more attractive than they have been in the last two decades. They finally offer a viable alternative for investors. US stocks appear slightly overvalued relative to history and when compared to other developed countries. However, this is almost entirely due to a few high valuation mega cap tech stocks that have driven index returns. It is encouraging that worldwide, including the US market ex mega tech stocks, stock valuations are modest.

What are the portfolio implications?

Disclosure

Past performance is not indicative of, and cannot ensure, future results.

Inflation Rates: Data provided by https://tradingeconomics.com/c... reference months are either September or October 2023

Bond Yield (10-Year): Data provided by https://tradingeconomics.com/b... November 2023

Country Descriptions: The countries stated in these tables are presented by Indices provided by MSCI inc. US-MSCI USA Index (USD) Canada-MSCI Canada Index (USD) Switzerland-MSCI Switzerland Index (USD) Australia-MSCI Australia Index (USD) France-MSCI France Index (USD) Germany-MSCI Germany Index (USD) Japan-MSCI Japan Index (USD) UK-MSCI United Kingdom Index (USD)

Disclaimer: All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy, or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Diversification neither assures a profit nor guarantees against loss in a declining market. The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness.

INVEST SMARTER

Call (585) 485-0135 to discuss how a factor-based approach could pay off for you.